The Boston Consulting Group Square Or How to get out of the box and start thinking Continentally

In recent years there has been a proliferation of supposed right wing accounts posting old statues, buildings, machinery, and other achievements of the past, demanding a RETRVN but never asking why we stopped building such things. The real answers can, of course, never be discussed as it would offend the sensibilities of the FARA-right’s sugardaddies whose income is contingent on never answering this question.

As the author has no such restrictions, let us take a look at why capital today is not utilized to enrich society, but a vehicle for theft. The simplicity of the answers will both surprise and enrage you.

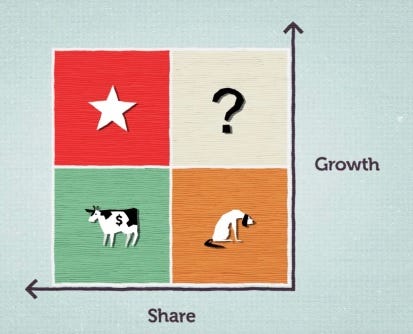

One of the most commonly employed ‘tools’ in modern businesses is the Boston Consulting Group (BCG) square, or the ‘growth share matrix’. This devious little graphic is a tool that exists to fulfill the purpose of the consulting group-that is, to drive all revenue towards investor returns. No other income is possible.

The BCG square considers only two concepts: first, the market share, and second, the growth potential. Nothing else can exist in this field, no noble goals, art, beauty, pride, national identity, much less Americana for everything must be either market share or cash flow.

The history of the square starts in the 1970s with the growth of modern business consulting as a result of the sixties conglomeration craze which saw disparate companies merged into huge unwieldy financial groups for the sole purpose of driving up their stock prices. This naturally led to a demand for third party services who could take the unpopular decisions needed to drive up stock prices, such as layoffs, outsourcing, and general cheapening of enterprise.

The square (or matrix) was introduced by BCG founder Bruce Henderson in an essay, The Product Portfolio. It is popularly taught in major business schools such as Harvard School of Business and commonly used in large multinational companies and parasitical consultancies such as McKinsey.

If the reader ever comes across some insane new business concept, fret not. It can be easily explained by the application of this simplistic matrix. The end goal is always looking for growth, hence the endless trend chasing at the expense of established working concepts.

Let us apply this tool to some common scenarios and see what a horrific invention Mr. Henderson unleashed upon the gentile world.

The most obvious application of the BCG matrix is towards war. Defense industries have been very profitable over the last 25 or so years.

In the lower RH corner, the Dog, not man’s best friend, but somehow a dogged condition which cannot be exploited for speculation. In this condition, to the horror of the speculator, there is a stable peace and isolationism, as promoted in America by General Washington and his policy of non-intervention. In this scenario, there is no great demand for war materiel, care for wounded veterans, or emergency procurement, price be damned. Defense industry is relegated to a government managed monopoly, where high grade government enterprises (such as arsenals, shipyards, ammunition plants, or research facilities) exist not as profit seekers but to create national defense capabilities. This scenario does not offer opportunities in massive growth for speculators. Profits might be low, but they are steady and redirected towards future investment. This scenario also works well in fixed cost plus price contracts since moral Americans can be engaged in technologically risky enterprise without fear of failure.

In the lower LH corner we have the Cash Cow, a scenario reminiscent of the post 1991 NATO alliance where no real threat can be discerned but the American middle class is massively taxed to keep this charade going, providing a large cash flow that can be exploited in low growth bloated acquisitions with (just like the alliance) no well defined purpose. In this scenario, a fixed cost plus contract provides an opportunity for grift as the costs can be inflated and passed into the speculators in the equities market. Not an ideal scenario for speculators but one well suited for creation of debt zombies that remove productive enterprise from the nation.

In the upper RH corner, the Question Marks, a scenario where growth is high but cash flow is questionable. This is trademark small wars, counterinsurgencies and anti-terror campaigns where emergency cash is thrown at the problem but long term solutions are uncertain. Such a scenario provides ample opportunity for contracting (such as outfitting local units, training and support that would be politically inexpedient or other private security contracting). Such small wars are in many cases tied to resource extraction (such as oil and mining rights) where the profits of war are directly related to exploitation of local resources. While the cash flow in this scenario are questionable, the growth rate can be very high. Let us think about this for a second, the attractive point here is that war can grow to be bigger, bloodier and more destructive leading to high profits. Thus, in a BCG driven business there always a demand to expand any conflict since it will lead to higher cash flows.

Any and all conflict is a ripe business opportunity to grow, and since the modern business’ only allegiance is to deliver shareholder value, businesses will seek to exploit conflict. Thus modern endless war is a built in feature of modern multinational shareholder business. War is one of the most profitable ventures for multinationals as war is extraction of the deepest levels of wealth form sovereign countries.

Thus we come to the most preferred outcome in business consulting, the Star, and what is the star in the war square? It is total, cataclysmic war with no end, no solution, and non-stop consumption of materiel at the highest levels. Catering to destruction is the ultimate fulfillment of the BCG square. Perhaps we should treat the BCG square as no different than ancient evil idols who promise to unleash the end of the world?

The solutions to all the horrid evils of such managerial ‘innovations’ is very simple, time proven and appeals to everyone who is not a moral lacking speculator.

The answers lie in the Political System of Economy which promotes peaceful and useful National enterprise, secures prosperity, treats fellow Americans as people and promotes the National Character.